Business, 26.09.2019 18:20, Lcorbett7414

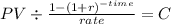

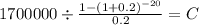

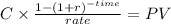

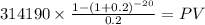

Auniversity spent $1.7 million to install solar panels atop a parking garage. these panels will have a capacity of 300 kilowatts (kw) and have a life expectancy of 20 years. suppose that the discount rate is 20%, that electricity can be purchased at $0.10 per kilowatt-hour (kwh), and that the marginal cost of electricity production using the solar panels is zero. hint: it may be easier to think of the present value of operating the solar panels for 1 hour per year first. approximately how many hours per year will the solar panels need to operate to enable this project to break even? 10,472.99 17,454.99 5,818.33 11,636.66 if the solar panels can operate only for 10,473 hours a year at maximum, the project break even. continue to assume that the solar panels can operate only for 10,473 hours a year at maximum. in order for the project to be worthwhile (i. e., at least break even), the university would need a grant of at least

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 11:00, littlesami105

Which ranks these careers that employers are most likely to hire from the least to the greatest?

Answers: 2

Business, 22.06.2019 12:10, FARHAN14082000

This exercise illustrates that poor quality can affect schedules and costs. a manufacturing process has 130 customer orders to fill. each order requires one component part that is purchased from a supplier. however, typically, 3% of the components are identified as defective, and the components can be assumed to be independent. (a) if the manufacturer stocks 130 components, what is the probability that the 130 orders can be filled without reordering components? (b) if the manufacturer stocks 132 components, what is the probability that the 130 orders can be filled without reordering components? (c) if the manufacturer stocks 135 components, what is the probability that the 130 orders can be filled without reordering components?

Answers: 3

Business, 22.06.2019 22:40, tonypewitt

Johnson company uses the allowance method to account for uncollectible accounts receivable. bad debt expense is established as a percentage of credit sales. for 2018, net credit sales totaled $6,400,000, and the estimated bad debt percentage is 1.40%. the allowance for uncollectible accounts had a credit balance of $61,000 at the beginning of 2018 and $49,500, after adjusting entries, at the end of 2018.required: 1. what is bad debt expense for 2018 as a percent of net credit sales? 2. assume johnson makes no other adjustment of bad debt expense during 2018. determine the amount of accounts receivable written off during 2018.3. if the company uses the direct write-off method, what would bad debt expense be for 2018?

Answers: 1

Do you know the correct answer?

Auniversity spent $1.7 million to install solar panels atop a parking garage. these panels will have...

Questions in other subjects:

History, 26.02.2021 21:20

Mathematics, 26.02.2021 21:20

Biology, 26.02.2021 21:20

Mathematics, 26.02.2021 21:20

Mathematics, 26.02.2021 21:20

Chemistry, 26.02.2021 21:20

Health, 26.02.2021 21:20