Business, 26.09.2019 17:30, tacojordan4128

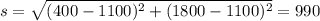

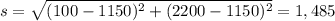

Consider an investment that pays off $700 or $1,400 per $1,000 invested with equal probability. suppose you have $1,000 but are willing to borrow to increase your expected return. what would happen to the expected value and standard deviation of the investment if you borrowed an additional $1,000 and invested a total of $2,000? what if you borrowed $2,000 to invest a total of $3,000?

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 20:30, marklynr9955

Resources that are valuable but not rare can be categorized asanswers: organizational weaknesses. distinctive competencies. organizational strengths. complementary resources and capabilities.

Answers: 1

Business, 22.06.2019 10:40, emojigirl5754

Two assets have the following expected returns and standard deviations when the risk-free rate is 5%: asset a e(ra) = 18.5% σa = 20% asset b e(rb) = 15% σb = 27% an investor with a risk aversion of a = 3 would find that on a risk-return basis. a. only asset a is acceptable b. only asset b is acceptable c. neither asset a nor asset b is acceptable d. both asset a and asset b are acceptable

Answers: 2

Business, 22.06.2019 19:20, cathydaves

Bcorporation, a merchandising company, reported the following results for october: sales $ 490,000 cost of goods sold (all variable) $ 169,700 total variable selling expense $ 24,200 total fixed selling expense $ 21,700 total variable administrative expense $ 13,200 total fixed administrative expense $ 33,600 the contribution margin for october is:

Answers: 1

Business, 22.06.2019 20:40, homework1911

Cherokee inc. is a merchandiser that provided the following information: amount number of units sold 20,000 selling price per unit $ 30 variable selling expense per unit $ 4 variable administrative expense per unit $ 2 total fixed selling expense $ 40,000 total fixed administrative expense $ 30,000 beginning merchandise inventory $ 24,000 ending merchandise inventory $ 44,000 merchandise purchases $ 180,000 required: 1. prepare a traditional income statement. 2. prepare a contribution format income statement.

Answers: 2

Do you know the correct answer?

Consider an investment that pays off $700 or $1,400 per $1,000 invested with equal probability. supp...

Questions in other subjects:

English, 09.11.2019 19:31

History, 09.11.2019 19:31

Mathematics, 09.11.2019 19:31

Chemistry, 09.11.2019 19:31

History, 09.11.2019 19:31