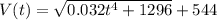

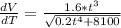

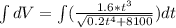

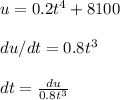

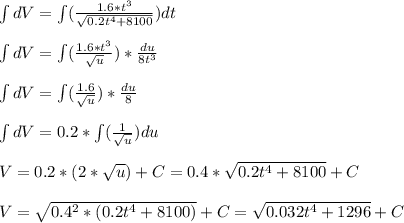

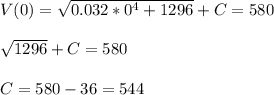

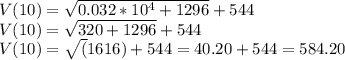

It is estimated that t years from now, the value of a small piece of land, v(t), will be increasing at a rate of √1.6t30.2t4+8100 dollars per year. the land is currently worth $580. set up the integral needed to solve the problem, and then find the value of the land after 10 years to the nearest cent.

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 02:30, walterzea70

rural residential development company and suburban real estate corporation form a joint stock company. the longest duration a joint stock company can be formed for is

Answers: 2

Business, 22.06.2019 03:00, autumn8668

Afirm's before-tax cost of debt, rd, is the interest rate that the firm must pay on debt. because interest is tax deductible, the relevant cost of debt used to calculate a firm's wacc is the cost of debt, rd (1 – t). the cost of debt is used in calculating the wacc because we are interested in maximizing the value of the firm's stock, and the stock price depends on cash flows. it is important to emphasize that the cost of debt is the interest rate on debt, not debt because our primary concern with the cost of capital is its use in capital budgeting decisions. the rate at which the firm has borrowed in the past is because we need to know the cost of capital. for these reasons, the on outstanding debt (which reflects current market conditions) is a better measure of the cost of debt than the . the on the company's -term debt is generally used to calculate the cost of debt because more often than not, the capital is being raised to fund -term projects. quantitative problem: 5 years ago, barton industries issued 25-year noncallable, semiannual bonds with a $1,600 face value and a 8% coupon, semiannual payment ($64 payment every 6 months). the bonds currently sell for $845.87. if the firm's marginal tax rate is 40%, what is the firm's after-tax cost of debt? round your answer to 2 decimal places. do not round intermediate calcu

Answers: 3

Business, 22.06.2019 09:50, shanedawson19

Is exploiting a distinctive competence or improving efficiency for competitive advantage. (a) cooptation (b) coalition (c) competitive intelligence (d) competitive aggression (e) smoothing

Answers: 1

Business, 22.06.2019 10:30, foreignlove1039

When sending a claim to an insurance company for services provided by the physician, why are both icd-10 and cpt codes required to be submitted? how are these codes dependent upon each other? what would be the result of not submitting both codes on a medical claim to an insurance company?

Answers: 2

Do you know the correct answer?

It is estimated that t years from now, the value of a small piece of land, v(t), will be increasing...

Questions in other subjects:

Business, 04.07.2019 15:50

English, 04.07.2019 15:50

Physics, 04.07.2019 15:50

Mathematics, 04.07.2019 15:50

Geography, 04.07.2019 15:50