Business, 21.09.2019 02:30, trobbie817

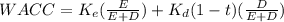

Rumolt motors has 24 million shares outstanding with a price of $ 13 per share. in addition, rumolt has issued bonds with a total current market value of $ 368 million. suppose rumolt's equity cost of capital is 9 %, and its debt cost of capital is 5 %. a. what is rumolt's pretax weighted average cost of capital? b. if rumolt's corporate tax rate is 21 %, what is its after-tax weighted average cost of capital? a. what is rumolt's pretax weighted average cost of capital? rumolt's pretax weighted average cost of capital is 6.83%. (round to two decimal places.) b. if rumolt's corporate tax rate is 21 %, what is its after-tax weighted average cost of capital? rumolt's after-tax weighted average cost of capital is 6.04%. (round to two deci

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 07:30, cherylmorton7302

What is the relationship between the national response framework and the national incident management system (nims)? a. the national response framework replaces the nims, which is now obsolete. b. the response protocols and structures described in the national response framework align with the nims, and all nims components support response. c. the nims relates to local, state, and territorial operations, whereas the nrf relates strictly to federal operations. d. the nims and the national response framework cover different aspects of incident management—the nims is focused on tactical planning, and the national response framework is focused on coordination.

Answers: 3

Business, 22.06.2019 12:00, ddaaaeeee3503

Which of the following is one of the advantages primarily associated with a performance appraisal? (a) it protects employees against discrimination on the basis of race. (b) it motivates employees to work on their shortcomings. (c) it encourages employees to play the role of the whistle-blower. (d) it accurately measures the resources of the firm.

Answers: 2

Business, 22.06.2019 12:40, daphnewibranowsky

Kumar consulting operates several stock investment portfolios that are used by firms for investment of pension plan assets. last year, one portfolio had a realized return of 12.6 percent and a beta coefficient of 1.15. the average t-bond rate was 7 percent and the realized rate of return on the s& p 500 was 12 percent. what was the portfolio's alpha?

Answers: 1

Business, 22.06.2019 19:30, Lucid4465

Which of the following constitute the types of unemployment occurring at the natural rate of unemployment? a. frictional and cyclical unemployment. b. structural and frictional unemployment. c. cyclical and structural unemployment. d. frictional, structural, and cyclical unemployment.

Answers: 2

Do you know the correct answer?

Rumolt motors has 24 million shares outstanding with a price of $ 13 per share. in addition, rumolt...

Questions in other subjects:

History, 17.01.2020 06:31

Chemistry, 17.01.2020 06:31

History, 17.01.2020 06:31

English, 17.01.2020 06:31

Biology, 17.01.2020 06:31

Mathematics, 17.01.2020 06:31