Business, 20.09.2019 18:20, ronniethefun

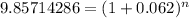

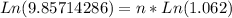

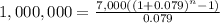

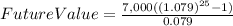

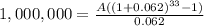

Danny has decided to retire once he has $1,000,000 in his retirement account. at the end of each year, he will contribute $7,000 to the account, which is expected to provide an annual return of 6.2%. how many years will it take until he can retire? 40 years 36 years 43 years 39 years 38 years suppose danny’s friend, hugh, has the same retirement plan, saving $7,000 at the end of each year and retiring once he hits $1,000,000. however, hugh’s account is expected to provide an annual return of 7.9%. how much sooner can hugh retire? 6 years 4 years 8 years 5 years 7 years after 25 years, neither danny nor hugh will have enough money to retire, but how much more will hugh’s account be worth at this time? $141,056 $139,984 $109,283 $289,671 $215,877 danny is jealous of hugh because hugh is scheduled to retire before him, so danny decides to make whatever end-of-year contribution is necessary to reach the $1,000,000 goal at the same time as hugh. if danny continues to earn 6.2% annual interest, what annual contributions must he make in order to retire at the same time as hugh? $7,751 $9,873 $16,452 $8,408 $13,241

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 20:30, heids17043

The link between volume of production and the cost of building manufacturing operations is particularly important in industries characterized byanswers: process innovations. product manufacturing. product innovation. process manufacturing.

Answers: 1

Business, 22.06.2019 14:40, annahm3173

In the fall of 2008, aig, the largest insurance company in the world at the time, was at risk of defaulting due to the severity of the global financial crisis. as a result, the u. s. government stepped in to support aig with large capital injections and an ownership stake. how would this affect, if at all, the yield and risk premium on aig corporate debt?

Answers: 3

Business, 22.06.2019 15:40, Zachary429

Brandt enterprises is considering a new project that has a cost of $1,000,000, and the cfo set up the following simple decision tree to show its three most likely scenarios. the firm could arrange with its work force and suppliers to cease operations at the end of year 1 should it choose to do so, but to obtain this abandonment option, it would have to make a payment to those parties. how much is the option to abandon worth to the firm?

Answers: 1

Business, 22.06.2019 16:30, cadenbukvich9923

Why is investing in a mutual fund less risky than investing in a particular company’s stock?

Answers: 3

Do you know the correct answer?

Danny has decided to retire once he has $1,000,000 in his retirement account. at the end of each yea...

Questions in other subjects:

Chemistry, 17.12.2020 22:50

Mathematics, 17.12.2020 22:50

History, 17.12.2020 22:50

Mathematics, 17.12.2020 22:50