For preparing the adjusting entries, the following data were assembled:

•

fees earned...

For preparing the adjusting entries, the following data were assembled:

•

fees earned but unbilled on november 30 were $9,440.

•

supplies on hand on november 30 were $5,130.

•

depreciation of equipment was estimated to be $6,200 for the year.

•

the balance in unearned fees represented the november 1 receipt in advance for services to be provided. during november, $15,280 of the services were provided.

•

unpaid wages accrued on november 30 were $5,230.

required:

1.

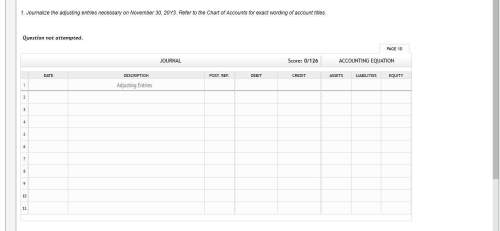

journalize the adjusting entries necessary on november 30, 20y3. refer to the chart of accounts for exact wording of account titles.

2.

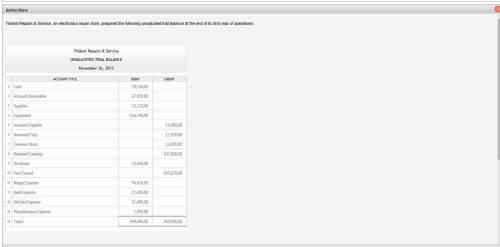

determine the revenues, expenses, and net income of trident repairs & service before the adjusting entries.

3.

determine the revenues, expenses, and net income of trident repairs & service after the adjusting entries.

4.

determine the effect of the adjusting entries on retained earnings.

chart of accounts

trident repairs & service

general ledger

assets

11

cash

12

accounts receivable

13

supplies

14

equipment

15

accumulated depreciation-equipment

liabilities

21

accounts payable

22

wages payable

23

unearned fees

equity

31

common stock

32

retained earnings

33

dividends

revenue

41

fees earned

expenses

51

wages expense

52

rent expense

53

supplies expense

54

depreciation expense

56

utilities expense

59

miscellaneous expense

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 23:20, christopherschool04

On october 2, 2016 starbucks corporation reported, on its form 10-k, the following (in millions): total assets $14,329.5 total stockholders' equity 5,890.7 total current liabilities 4,546.9 what did starbucks report as total liabilities on october 2, 2016? select one: a. $12,516.7 million b. $6,377.3 million c. $995.0 million d. $8,438.8 million e. none of the above

Answers: 2

Business, 22.06.2019 02:30, Roof55

When interest is compounded continuously, the amount of money increases at a rate proportional to the amount s present at time t, that is, ds/dt = rs, where r is the annual rate of interest. (a) find the amount of money accrued at the end of 3 years when $4000 is deposited in a savings account drawing 5 3 4 % annual interest compounded continuously. (round your answer to the nearest cent.) $ (b) in how many years will the initial sum deposited have doubled? (round your answer to the nearest year.) years (c) use a calculator to compare the amount obtained in part (a) with the amount s = 4000 1 + 1 4 (0.0575) 3(4) that is accrued when interest is compounded quarterly. (round your answer to the nearest cent.) s = $

Answers: 1

Business, 22.06.2019 13:40, dathanboyd

Jacob is a member of wcc (an llc taxed as a partnership). jacob was allocated $155,000 of business income from wcc for the year. jacob’s marginal income tax rate is 37 percent. the business allocation is subject to 2.9 percent of self-employment tax and 0.9 percent additional medicare tax. (round your intermediate calculations to the nearest whole dollar a) what is the amount of tax jacob will owe on the income allocation if the income is not qualified business income? b) what is the amount of tax jacob will owe on the income allocation if the income is qualified business income (qbi) and jacob qualifies for the full qbi duduction?

Answers: 2

Business, 22.06.2019 21:30, natasniebow

True or false payroll withholding includes income tax, social security tax, medicare tax as well as money you deduct for your retirement fund.

Answers: 1

Do you know the correct answer?

Questions in other subjects:

History, 29.07.2019 22:20

History, 29.07.2019 22:20

Mathematics, 29.07.2019 22:20