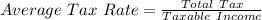

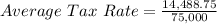

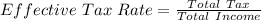

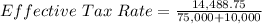

Chuck, a single taxpayer, earns $75,000 in taxable income and $10,000 in interest from an investment in city of heflin bonds. (use the u. s tax rate (do not round intermediate calculations. round "federal tax" to 2 decimal places.)a. how much federal tax will he owe? b. what is his average tax rate? c. what is his effective tax rate? d. what is his current marginal tax rate?

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 10:00, tiarafaimealelei

The solution set for -18 < 5x-3 iso-3х3< xо-3хo3 > x

Answers: 3

Business, 22.06.2019 17:30, leannhb3162

Aproject currently generates sales of $14 million, variable costs equal 50% of sales, and fixed costs are $2.8 million. the firm’s tax rate is 40%. assume all sales and expenses are cash items. (a). what are the effects on cash flow, if sales increase from $14 million to $15.4 million? (input the amount as positive value. enter your answer in dollars not in (b) what are the effects on cash flow, if variable costs increase to 60% of sales? (input the amount as positive value. enter your answers in dollars not in millions). cash flow (increase or decrease) by $

Answers: 2

Business, 22.06.2019 18:30, spazzinchicago

Health insurance protects you if you experience any of the following except: a: if you have to be hospitalized b: if you damage someone's property c: if you need to visit a clinic d: if you can't work because of illness

Answers: 2

Do you know the correct answer?

Chuck, a single taxpayer, earns $75,000 in taxable income and $10,000 in interest from an investment...

Questions in other subjects:

Mathematics, 28.03.2020 03:01

Mathematics, 28.03.2020 03:01

Mathematics, 28.03.2020 03:01

Mathematics, 28.03.2020 03:01

English, 28.03.2020 03:01

English, 28.03.2020 03:01

Geography, 28.03.2020 03:01