Business, 18.09.2019 22:30, anitadefrances

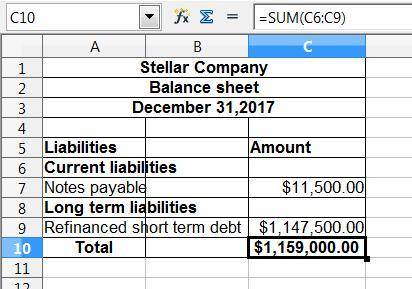

On december 31, 2017, stellar company had $1,159,000 of short-term debt in the form of notes payable due february 2, 2018. on january 21, 2018, the company issued 25,500 shares of its common stock for $45 per share, receiving $1,147,500 proceeds after brokerage fees and other costs of issuance. on february 2, 2018, the proceeds from the stock sale, supplemented by an additional $11,500 cash, are used to liquidate the $1,159,000 debt. the december 31, 2017, balance sheet is issued on february 23, 2018.show how the $1,159,000 of short-term debt should be presented on the december 31, 2017, balance sheet.

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 19:20, natajayd

The following information is from the 2019 records of albert book shop: accounts receivable, december 31, 2019 $ 42 comma 000 (debit) allowance for bad debts, december 31, 2019 prior to adjustment 2 comma 000 (debit) net credit sales for 2019 179 comma 000 accounts written off as uncollectible during 2017 15 comma 000 cash sales during 2019 28 comma 500 bad debts expense is estimated by the method. management estimates that $ 5 comma 300 of accounts receivable will be uncollectible. calculate the amount of bad debts expense for 2019.

Answers: 2

Business, 23.06.2019 02:30, 310000982

On december 1, 2017, bigham corporation pays a dividend of $4.00 on each share of its common stock. vanessa and gena, two unrelated shareholders, each own 5,000 shares of the stock. vanessa has owned her stock for two years while gena purchased her stock on november 3, 2017. how does each shareholder treat the $20,000 dividend from bigham

Answers: 3

Business, 23.06.2019 06:00, dragon2998

Legal requirements, suppliers and distributors, competitors, and market profiles are contained in the element of your business plan. a. introduction b. operating plant c. industry d. business information

Answers: 1

Business, 23.06.2019 22:00, cheesecake1919

Mcgraw-hill education uses $3,800 worth of electricity and natural gas in its headquarters building for which it has not yet been billed. at the beginning of january, turner construction company pays $963 for magazine advertising to run in monthly publications each of the first three months of the year. dell pays its computer service technicians $403,000 in salaries for the two weeks ended january 7. answer from dell's standpoint. the university of florida orders 60,000 season football tickets from its printer and pays $8,340 in advance for the custom printing. the first game will be played in september. answer from the university's standpoint.

Answers: 3

Do you know the correct answer?

On december 31, 2017, stellar company had $1,159,000 of short-term debt in the form of notes payable...

Questions in other subjects: