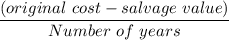

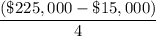

Equipment with a cost of $225,000 has an estimated salvage value of $15,000 and an estimated life of 4 years or 10,000 hours. it is to be depreciated by the straight-line method. what is the amount of depreciation for the first full year, during which the equipment was used 2,700 hours?

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 21:30, Studyhard4706

8. agreement and disagreement among economists suppose that bob, an economist from a university in arizona, and cho, an economist from a public television program, are arguing over saving incentives. the following dialogue shows an excerpt from their debate: cho: i think it's safe to say that, in general, the savings rate of households in today's economy is much lower than it really needs to be to sustain an improvement in living standards. bob: i think a switch from the income tax to a consumption tax would bring growth in living standards. cho: you really think households would change their saving behavior enough in response to this to make a difference? because i don't. the disagreement between these economists is most likely due to . despite their differences, with which proposition are two economists chosen at random most likely to agree? rent ceilings reduce the quantity and quality of available housing. immigrants receive more in government benefits than they contribute in taxes. having a single income tax rate would improve economic performance.

Answers: 1

Business, 21.06.2019 23:30, aaroneduke4576

Consider the following scenarios. use what you have learned to decide if the goods and services being provided are individual, public, or merit goods. for each case, state what kind of good has been described and explain your answer using the definitions of individual, public, and merit goods. (6 points each) 1. from your window, you can see a city block that's on fire. you watch city firefighters rescue people and battle the flames to save the buildings. 2. while visiting relatives, you learn that your cousins attend a nearby elementary school that is supported financially by local property tax revenue. 3. you see a squadron of military jets flying overhead. 4. you find out that your aunt works for a defense manufacturing company that has several defense contracts with the government. she tells you that she works for a team that is producing a communications satellite. 5. your class visits a local jail run by a private, profit-making company that detains county criminals and is paid with tax revenue.

Answers: 1

Business, 22.06.2019 02:30, linaaaaa7

Consider how health insurance affects the quantity of health care services performed. suppose that the typical medical procedure has a cost of $160, yet a person with health insurance pays only $40 out of pocket. her insurance company pays the remaining $120. (the insurance company recoups the $120 through premiums, but the premium a person pays does not depend on how many procedures that person chooses to undergo.) consider the following demand curve in the market for medical care. use the black point (plus symbol) to indicate the quantity of procedures demanded if each procedure has a price of $160. then use the grey point (star symbol) to indicate the quantity of procedures demanded if each procedure has a price of $40. q d at p=$160 q d at p=$40 0 10 20 30 40 50 60 70 80 90 100 200 180 160 140 120 100 80 60 40 20 0 price of medical procedures quantity of medical procedures demand if the cost of each procedure to society is truly $160, the quantity that maximizes total surplus is procedures. economists often blame the health insurance system for excessive use of medical care. given your analysis, the use of care might be viewed as excessive because consumers get procedures whose value is than the cost of producing them.

Answers: 1

Business, 22.06.2019 09:40, watervliet2586

The relationship requirement for qualifying relative requires the potential qualifying relative to have a family relationship with the taxpayer. t or fwhich of the following is not a from agi deduction? a. standard deductionb. itemized deductionc. personal exemptiond. none of these. all of these are from agi deductions

Answers: 3

Do you know the correct answer?

Equipment with a cost of $225,000 has an estimated salvage value of $15,000 and an estimated life of...

Questions in other subjects:

History, 07.01.2021 01:30

Arts, 07.01.2021 01:30

History, 07.01.2021 01:30

Health, 07.01.2021 01:30

Mathematics, 07.01.2021 01:30

Biology, 07.01.2021 01:30

English, 07.01.2021 01:30

Mathematics, 07.01.2021 01:30