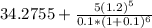

Consider the following three stocks: stock a is expected to provide a dividend of $10 a share forever. stock b is expected to pay a dividend of $5 next year. thereafter, dividend growth is expected to be 4% a year forever. stock c is expected to pay a dividend of $5 next year. thereafter, dividend growth is expected to be 20% a year for five years (i. e., years 2 through 6) and zero thereafter. if the market capitalization rate for each stock is 10%, which stock is the most valuable?

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 01:30, bigsmokedagangsta

Iam trying to get more members on my blog. how do i do that?

Answers: 2

Business, 22.06.2019 12:20, mxrvin4977

In terms of precent, beer has more alcohol than whiskey true or false

Answers: 1

Business, 22.06.2019 14:30, mathhelppls14

If a product goes up in price, and the demand for it drops, that product's demand is a. elastic b. inelastic c. stable d. fixed select the best answer from the choices provided

Answers: 1

Business, 22.06.2019 16:10, safiyyahrahman6907

From what part of income should someone take savings?

Answers: 2

Do you know the correct answer?

Consider the following three stocks: stock a is expected to provide a dividend of $10 a share forev...

Questions in other subjects:

Computers and Technology, 03.12.2019 21:31

Chemistry, 03.12.2019 21:31

Computers and Technology, 03.12.2019 21:31

Mathematics, 03.12.2019 21:31

Mathematics, 03.12.2019 21:31

=$100

=$100

= $83.33

= $83.33

=$104.51

=$104.51