Business, 18.09.2019 02:00, nathaliapachon7948

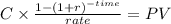

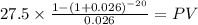

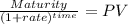

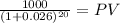

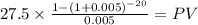

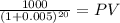

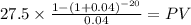

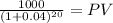

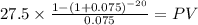

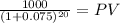

A10-year u. s. treasury bond with a face value of $1,000 pays a coupon of 5.5% (2.75% of face value every six months). the reported yield to maturity is 5.2% (a six-month discount rate of 5.2/2 = 2.6%). what is the present value of the bond? if the yield to maturity changes to 1%, what will be the present value? if the yield to maturity changes to 8%, what will be the present value? if the yield to maturity changes to 15%, what will be the present value?

Answers: 3

Similar questions

Mathematics, 12.08.2019 19:20, lazavionadams81

Answers: 2

Business, 15.10.2019 23:10, tayler4766

Answers: 1

Business, 17.10.2019 00:30, johnathan1104

Answers: 1

Business, 17.10.2019 19:00, batmanmarie2004

Answers: 2

Do you know the correct answer?

A10-year u. s. treasury bond with a face value of $1,000 pays a coupon of 5.5% (2.75% of face value...

Questions in other subjects:

Computers and Technology, 03.07.2021 02:40