Business, 13.09.2019 01:30, killinit143

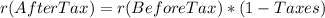

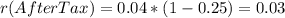

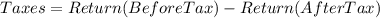

Jack has $1,000 to invest. he has a choice between municipal bonds with an interest rate of 4% or corporate bonds with an interest rate of 6%. jack has a marginal tax rate of 25%. given this information, jack should invest in the bonds. the after-tax rate of return on the municipal bonds is % and the after tax rate of return on the corporate bonds is %. the difference in the rates of return is known as taxes.

Answers: 3

Similar questions

Business, 02.07.2019 01:20, noberoger2780

Answers: 2

Business, 05.08.2019 19:20, alyo31500

Answers: 1

Business, 18.09.2019 01:00, jenn8055

Answers: 1

Business, 10.10.2019 05:00, jcox626

Answers: 3

Do you know the correct answer?

Jack has $1,000 to invest. he has a choice between municipal bonds with an interest rate of 4% or co...

Questions in other subjects:

Mathematics, 13.01.2021 19:20

Mathematics, 13.01.2021 19:20

Mathematics, 13.01.2021 19:20

Mathematics, 13.01.2021 19:20

History, 13.01.2021 19:20

Mathematics, 13.01.2021 19:20