Business, 12.09.2019 19:20, cthompson1107

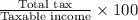

Assume a single taxpayer is taxed at 10% on the first $9,275 of taxable income, 15% on the next $28,375 of income, and at 25% for the following $53,500 of income. what is the average tax rate for that individual if her taxable income is $42,000?

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 20:30, christinachavez081

The federal act which provided over $7 billion to the epa to protect and promote "green" jobs and a healthier environment is the - national environmental policy act. - resource recovery act.- resource conservation and recovery act.- american recovery and reinvestment act. - clean air act.

Answers: 1

Business, 22.06.2019 18:00, HistoryLee

1. what is the amount of interest earned after two years on a $100 deposit paying 4 percent simple interest annually? $8.00 $4.08 $8.16 $4.00 2. what is the amount of compound interest earned after three years on a $100 deposit paying 8 percent interest annually? $24.00 $8.00 $16.64 $25.97 3. a business just took out a loan for $100,000 at 10% interest. if the business pays the loan off in three months, how much did the business pay in interest? $2,500.00 $10.00 $250.00 $10,000.00 4. what is the annual percentage yield (apy) for a deposit paying 5 percent interest with monthly compounding? 5.00% 5.12% 79.59% 0.42%

Answers: 1

Business, 22.06.2019 19:30, jaybeast40

Oz makes lion food out of giraffe and gazelle meat. giraffe meat has 18 grams of protein and 36 grams of fat per pound, while gazelle meat has 36 grams of protein and 18 grams of fat per pound. a batch of lion food must contain at least "46,800" grams of protein and 70,200 grams of fat. giraffe meat costs $1/pound and gazelle meat costs $2/pound. how many pounds of each should go into each batch of lion food in order to minimize costs? hint [see example 2.]

Answers: 1

Do you know the correct answer?

Assume a single taxpayer is taxed at 10% on the first $9,275 of taxable income, 15% on the next $28,...

Questions in other subjects:

Health, 20.12.2020 04:50

Business, 20.12.2020 04:50

Mathematics, 20.12.2020 04:50

Biology, 20.12.2020 04:50

Mathematics, 20.12.2020 04:50

Law, 20.12.2020 04:50

Mathematics, 20.12.2020 04:50