Business, 11.09.2019 00:20, hannahs1313

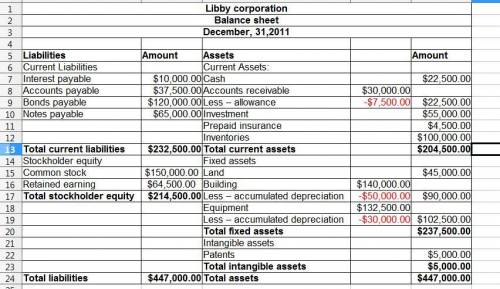

The december 31, 2011, post closing trial balance in thousands for libby corporations is preseted below

debit credit

cash 22,500

investments 55,000

accouts recievable 30,000

allownnce for uncollectible accounts 7,500

prepaid insurance 4,500

inventories 100,000

land 45,000

buildings 140,000

accumulated depreciation-buildings 50,000

equipment 132,500

accumulated depreciation-equipment 30,000

patents(unamortized balance) 5,000

accounts payable 37,500

notes payable, due 2012 65,000

interest payable 10,000

bonds payable due 2021 120,000

common stock 150,000

retained earnings 64,500

total 534,500 534,500

prepare a classified balance sheet for libby corporation at december 31,2011

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 19:20, melissareid65

25. kerry company plans to sell 200,000 units of finished product in july and anticipates a growth rate in sales of 5% per month. the desired monthly ending inventory in units of finished product is 80% of the next month's estimated sales. there are 150,000 finished units in inventory on june 30. kerry company's production requirement in units of finished product for the three-month period ending september 30 is: a. 712,025 units b. 630,500 units c. 664,000 units d. 665,720 units

Answers: 3

Business, 21.06.2019 22:30, petunia6548

True or false: banks are required to make electronically deposited funds available on the same day of the deposit

Answers: 2

Business, 22.06.2019 10:10, manny2275

True tomato inc. makes organic ketchup. to promote its products, this firm decided to make bottles in the shape of tomatoes. to accomplish this, true tomato worked with its bottle manufacture to create a set of unique molds for its bottles. which of the following specialized assets does this example demonstrate? (a) site specificity (b) research specificity (c) physical-asset specificity (d) human-asset specificity

Answers: 3

Business, 22.06.2019 12:50, laxraAragon

Jallouk corporation has two different bonds currently outstanding. bond m has a face value of $50,000 and matures in 20 years. the bond makes no payments for the first six years, then pays $2,100 every six months over the subsequent eight years, and finally pays $2,400 every six months over the last six years. bond n also has a face value of $50,000 and a maturity of 20 years; it makes no coupon payments over the life of the bond. the required return on both these bonds is 10 percent compounded semiannually. what is the current price of bond m and bond n?

Answers: 3

Do you know the correct answer?

The december 31, 2011, post closing trial balance in thousands for libby corporations is preseted be...

Questions in other subjects:

English, 07.04.2020 21:20

Mathematics, 07.04.2020 21:20

Social Studies, 07.04.2020 21:20

English, 07.04.2020 21:20