Business, 10.09.2019 23:30, DaisyHargrove23

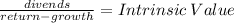

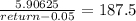

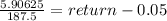

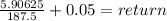

Nonconstant growth stock valuation assume that the average firm in your company's industry is expected to grow at a constant rate of 5% and that its dividend yield is 6%. your company is about as risky as the average firm in the industry and just paid a dividend (d0) of $3. you expect that the growth rate of dividends will be 50% during the first year (g0,1 = 50%) and 25% during the second year (g1,2 = 25%). after year 2, dividend growth will be constant at 5%. what is the required rate of return on your company’s stock? what is the estimated value per share of your firm’s stock? do not round intermediate calculations. round the monetary value to the nearest cent and percentage value to the nearest whole number.

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 18:30, emblemhacks

As the marginal propensity to consume (mpc) increases, the multiplier remains the same. increases. decreases. as the marginal propensity to save (mps) increases, the multiplier decreases. increases. remains the same. if the marginal propensity to consume is 0.30, what is the multiplier, assuming there are no taxes or imports? round to the tenths place. given the multiplier that you calculated, by how much will gross domestic product (gdp) increase when there is a $1,000 increase in government spending? $

Answers: 3

Business, 22.06.2019 02:30, maxicanofb0011

Based on the supply and demand theory, why do medical doctors earn higher wages than child-care workers?

Answers: 1

Business, 22.06.2019 16:50, mariposa91

In terms of the "great wheel of science", statistics are central to the research process (a) only between the hypothesis phase and the observation phase (b) only between the observation phase and the empirical generalization phase (c) only between the theory phase and the hypothesis phase (d) only between the empirical generalization phase and the theory phase

Answers: 1

Business, 22.06.2019 19:00, xcncxgnfxg6487

Consider the following information on stocks a, b, c and their returns (in decimals) in each state: state prob. of state a b c boom 20% 0.27 0.22 0.16 good 45% 0.16 0.09 0.07 poor 25% 0.03 0 0.03 bust 10% -0.08 -0.04 -0.02 if your portfolio is invested 25% in a, 40% in b, and 35% in c, what is the standard deviation of the portfolio in percent? answer to two decimals, carry intermediate calcs. to at least four decimals.

Answers: 2

Do you know the correct answer?

Nonconstant growth stock valuation assume that the average firm in your company's industry is expect...

Questions in other subjects:

Mathematics, 29.02.2020 04:47