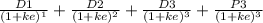

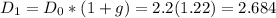

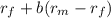

Acompany currently pays a dividend of $2.2 per share (d0 = $2.2). it is estimated that the company's dividend will grow at a rate of 22% per year for the next 2 years, and then at a constant rate of 7% thereafter. the company's stock has a beta of 1.4, the risk-free rate is 6.5%, and the market risk premium is 2%. what is your estimate of the stock's current price? do not round intermediate calculations. round your answer to the nearest cent.

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 01:00, natalie857123

When color is used on a topographical drawing, black is used to represent what?

Answers: 1

Business, 22.06.2019 19:30, livimal77

At december 31, 2016, pina corporation had the following stock outstanding. 10% cumulative preferred stock, $100 par, 107,810 shares $10,781,000 common stock, $5 par, 4,026,000 shares 20,130,000 during 2017, pina did not issue any additional common stock. the following also occurred during 2017. income from continuing operations before taxes $21,950,000 discontinued operations (loss before taxes) $3,505,000 preferred dividends declared $1,078,100 common dividends declared $2,300,000 effective tax rate 35 % compute earnings per share data as it should appear in the 2017 income statement of pina corporation

Answers: 1

Business, 22.06.2019 19:50, TylieW

Aproperty title search firm is contemplating using online software to increase its search productivity. currently an average of 40 minutes is needed to do a title search. the researcher cost is $2 per minute. clients are charged a fee of $400. company a's software would reduce the average search time by 10 minutes, at a cost of $3.50 per search. company b's software would reduce the average search time by 12 minutes at a cost of $3.60 per search. which option would have the higher productivity in terms of revenue per dollar of input?

Answers: 1

Business, 22.06.2019 21:30, sergiom6185

Russell's study compared gpa of those students who volunteered for academic study skills training and those who did not elect to take the training. he found that those who had the training also had higher gpa. with which validity threat should russell be most concerned?

Answers: 2

Do you know the correct answer?

Acompany currently pays a dividend of $2.2 per share (d0 = $2.2). it is estimated that the company's...

Questions in other subjects:

History, 17.03.2022 01:00

Mathematics, 17.03.2022 01:00

Mathematics, 17.03.2022 01:00

.

.

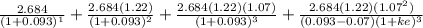

= 0.065+1.4(0.02)=0.093

= 0.065+1.4(0.02)=0.093

= 132.71

= 132.71