Business, 10.09.2019 18:30, kennrecklezz

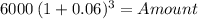

You recently invested $18,000 of your savings in a security issued by a large company. the security agreement pays you 6 percent per year and has a maturity three years from the day you purchased it. what is the total cash flow you expect to receive from this investment over the next three years?

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 21:00, jonathanvega424

There is just one person in our group, silvia, who seems to have radically different ideas about how to complete our project. she seems to purposely disagree with the majority opinions of the rest of us though yesterday she said something that made a lot of sense to us solve our production problem. i suggested to the entire group today that we hear silvia’s suggestions and asked silvia to share in-depth more of what she said yesterday. i am using which adaptive leader behavior?

Answers: 2

Business, 22.06.2019 21:10, stephany94

You are the manager of a large crude-oil refinery. as part of the refining process, a certain heat exchanger (operated at high temperatures and with abrasive material flowing through it) must be replaced every year. the replacement and downtime cost in the first year is $165 comma 000. this cost is expected to increase due to inflation at a rate of 7% per year for six years (i. e. until the eoy 7), at which time this particular heat exchanger will no longer be needed. if the company's cost of capital is 15% per year, how much could you afford to spend for a higher quality heat exchanger so that these annual replacement and downtime costs could be eliminated?

Answers: 1

Business, 22.06.2019 22:10, zahraa244

Afirm plans to begin production of a new small appliance. the manager must decide whether to purchase the motors for the appliance from a vendor at $10 each or to produce them in-house. either of two processes could be used for in-house production; process a would have an annual fixed cost of $200,000 and a variable cost of $7 per unit, and process b would have an annual fixed cost of $175,000 and a variable cost of $8 per unit. determine the range of annual volume for which each of the alternatives would be best. (round your first answer to the nearest whole number. include the indifference value itself in this answer.)

Answers: 2

Business, 22.06.2019 23:00, andersonmm22

The sign at the bank reads, "wait here for the first available teller," suggests the use of a waiting line system. a. multiple server, single phaseb. random server, single phasec. single server, multiphased. multiple server, multiphasee. dynamic server, single phase

Answers: 2

Do you know the correct answer?

You recently invested $18,000 of your savings in a security issued by a large company. the security...

Questions in other subjects:

Computers and Technology, 05.11.2020 21:10

Advanced Placement (AP), 05.11.2020 21:10

Mathematics, 05.11.2020 21:10

Health, 05.11.2020 21:10

Mathematics, 05.11.2020 21:10