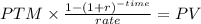

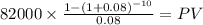

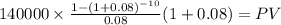

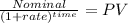

Harding company is in the process of purchasing several large pieces of equipment from danning machine corporation. several financing alternatives have been offered by danning: ((fv of $1, pv of $1, fva of $1, pva of $1, fvad of $1 and pvad of $1) (use appropriate factor(s) from the tables provided.) 1. pay $1,080,000 in cash immediately. 2.pay $400,000 immediately and the remainder in 10 annual installments of $82,000, with the first installment due in one year. 3. make 10 annual installments of $140,000 with the first payment due immediately. 4. make one lump-sum payment of $1,610,000 five years from date of purchase. required: determine the best alternative for harding, assuming that harding can borrow funds at a 8% interest rate. (round your final answers to nearest whole dollar amount.)

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 14:00, krishimotam

Employees who are paid to complete a task, such as build a house, are paid on a(n) basis

Answers: 1

Business, 21.06.2019 15:20, Chrisis9987

The beginning inventory is expected to be 2,000 cases. expected sales are 10,000 cases, and the company wishes to begin the next period with an inventory of 1,000 cases. the number of cases the company must purchase during the month is multiple choice 9,000 cases. 10,000 cases. 11,000 cases. 13,000 cases.

Answers: 1

Business, 23.06.2019 01:10, KariSupreme

Atariff on avocadoes the price of avocadoes, consumers' surplus for avocado buyers, producers' surplus of avocado growers and tariff revenue. because the loss to is more than the gain to there is a net loss to society. raises; decreases; increases; generates; consumers; producers and government raises; increases; decreases; does not generate; producers and government; consumers lowers; increases; decreases; does not generate; producers and government; consumers raises; increases; decreases; generates; producers; consumers and government

Answers: 2

Business, 23.06.2019 01:50, katelynbychurch

Consider a firm with a contract to sell an asset for $149,000 four years from now. the asset costs $85,000 to produce today. a. given a relevant discount rate of 14 percent per year, calculate the profit the firm will make on this asset. (a loss should be indicated by a minus sign. do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.) b. at what rate does the firm just break even?

Answers: 3

Do you know the correct answer?

Harding company is in the process of purchasing several large pieces of equipment from danning machi...

Questions in other subjects: