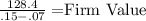

If the expected long-run growth rate for this stock is free cash flow during the just-ended year (t = 0) was $120 million, and fcf is expected to grow at a constant rate of 7% in the future. if the weighted average cost of capital is 15%, what is the firm's value of operations, in millions? 5%, and if investors' required rate of return is 11.5%, what is the current stock price?

Answers: 1

Similar questions

Business, 05.11.2019 03:31, kimsouther2

Answers: 3

Business, 13.11.2019 18:31, tykiabrown8111

Answers: 3

Business, 13.11.2019 19:31, Tyrant4life

Answers: 1

Do you know the correct answer?

If the expected long-run growth rate for this stock is free cash flow during the just-ended year (t...

Questions in other subjects:

Mathematics, 20.09.2019 05:00

Mathematics, 20.09.2019 05:00

Social Studies, 20.09.2019 05:00

French, 20.09.2019 05:00