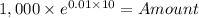

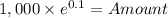

Calculate the following: a )suppose you wish to raise some money for your favorite local charity. this charity needs $50,000 a year to run their operation and you want to make sure that they are ensured an annual payment of this amount from now on for every in the foreseeable future. given an interest rate of 5%, how much would you have to fund this perpetuity to guarantee this charity a payment of $50,000 per year? b)you decide to put $1,000 in a new bank account and don’t plan to withdraw the money for 10 years. if your bank does continuous compounding and the interest rate is 1%, what will be the future value of this bank account in 10 years?

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 15:30, Andrebutrus

Should the government be downsized? which functions should be cut back? which ones should be expanded?

Answers: 2

Business, 22.06.2019 21:30, mjstew00763

An allergy products superstore buys 6000 of their most popular model of air filters each year. the price of the air filters is $18. the cost of ordering and receiving shipments is $12 per order. accounting estimates annual carrying costs are 20% of the price. the supplier lead time is 2 days. the store operates 240 days per year. each order is received from the supplier in a single delivery. there are no quantity discounts. what is the store’s minimum total annual cost of placing orders & carrying inventory?

Answers: 1

Business, 23.06.2019 01:00, ashley232323

Need with an adjusting journal entrycmc records depreciation and amortization expense annually. they do not use an accumulated amortization account. (i. e. amortization expense is recorded with a debit to amort. exp and a credit to the patent.) annual depreciation rates are 7% for buildings/equipment/furniture, no salvage. (round to the nearest whole dollar.) annual amortization rates are 10% of original cost, straight-line method, no salvage. cmc owns two patents: patent #fj101 and patent #cq510. patent #cq510 was acquired on october 1, 2016. patent #fj101 was acquired on april 1, 2018 for $119,000. the last time depreciation & amortization were recorded was december 31, 2017.before adjustment: land: 348791equpment and furniture: 332989building: 876418patents 217000

Answers: 3

Do you know the correct answer?

Calculate the following: a )suppose you wish to raise some money for your favorite local charity. th...

Questions in other subjects:

Mathematics, 07.04.2021 19:10

Mathematics, 07.04.2021 19:10

Mathematics, 07.04.2021 19:10

Social Studies, 07.04.2021 19:10