Business, 27.08.2019 03:20, Quakersoatmeal9

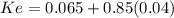

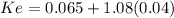

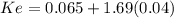

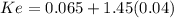

Which one of the following stocks, if any, is correctly priced according to capm if the risk-free rate of return is 6.5 percent and the market rate of return is 10.5 percent? stock a with a beta of .85 and an expected return of 9.22 percent; stock b with a beta of 1.08 and an expected return of 11.90 percent; stock c with a beta of 1.69 and an expected return of 15.38 percent; stock d with a beta of 1.45 and an expected return of 12.30 percent.

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 19:10, ebonsell4910

King fisher aviation is evaluating an investment project with the following case flows: $6,000 $5,500 $7,000 $8,000 discount rate 14 percent what is the discounted payback period for these cash flows if the initial cost is 15,000? what if the initial cost is $12,000? what if the cost is $16,000?

Answers: 1

Business, 22.06.2019 01:00, cranfordjacori

Cooper, cpa, is auditing the financial statements of a small rural municipality. the receivable balances represent residents’ delinquent real estate taxes. internal control at the municipality is weak. to determine the existence of the accounts receivable balances at the balance sheet date, cooper would most likely: cooper, cpa, is auditing the financial statements of a small rural municipality. the receivable balances represent residents’ delinquent real estate taxes. internal control at the municipality is weak. to determine the existence of the accounts receivable balances at the balance sheet date, cooper would most likely:

Answers: 3

Business, 22.06.2019 15:00, Jocelynrichards

Why entrepreneurs start businesses. a) monopolistic competition b) perfect competition c) sole proprietorship d) profit motive

Answers: 1

Business, 22.06.2019 18:00, firesoccer53881

If you would like to ask a question you will have to spend some points

Answers: 1

Do you know the correct answer?

Which one of the following stocks, if any, is correctly priced according to capm if the risk-free ra...

Questions in other subjects:

English, 26.09.2019 23:00

English, 26.09.2019 23:00

Mathematics, 26.09.2019 23:00

Chemistry, 26.09.2019 23:00