Business, 27.08.2019 03:10, DakotaOliver

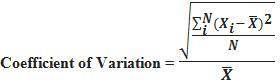

Mr. sam golff desires to invest a portion of his assets in rental property. he has narrowed his choices down to two apartment complexes, palmer heights and crenshaw village. after conferring with the present owners, mr. golff has developed the following estimates of the cash flows for these properties. palmer heights crenshaw village yearly aftertax yearly aftertaxcash inflow cash inflow(in thousands) probability (in thousands) probability$70 0.2 $75 0.2$75 0.2 $80 0.3$90 0.2 $90 0.4$105 0.2 $100 0.1$110 0.2a. find the expected cash flow from each apartment complex. b. what is the coefficient of variation for each apartment complex? c. which apartment complex has more risk?

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 05:20, alexandroperez13

Carmen co. can further process product j to produce product d. product j is currently selling for $20 per pound and costs $15.75 per pound to produce. product d would sell for $38 per pound and would require an additional cost of $8.55 per pound to produce. what is the differential revenue of producing product d?

Answers: 2

Business, 22.06.2019 20:20, nicky123415

Amanager of a store that sells and installs spas wants to prepare a forecast for january and june of next year. her forecasts are a combination of trend and seasonality. she uses the following equation to estimate the trend component of monthly demand: ft = 30+5t, where t = 1 in january of this year. seasonal relatives are 0.60 for january and 1.50 for june. what demands should she predict for january and june of next year

Answers: 2

Business, 23.06.2019 03:20, Wolfgirl2032

Suppose that fixed costs for a firm in the automobile industry (start-up costs of factories, capital equipment, and so on) are $5 billion and that variable costs are equal to $17,000 per finished automobile. because more firms increase competition in the market, the market price falls as more firms enter an automobile market, or specifically, , where n represents the number of firms in a market. assume that the initial size of the u. s. and the european automobile markets are 300 million and 533 million people, respectively. a. calculate the equilibrium number of firms in the u. s. and european automobile markets without trade. b. what is the equilibrium price of automobiles in the united states and europe if the automobile industry is closed to foreign trade? c. now suppose that the united states decides on free trade in automobiles with europe. the trade agreement with the europeans adds 533 million consumers to the automobile market, in addition to the 300 million in the united states. how many automobile firms will there be in the united states and europe combined? what will be the new equilibrium price of automobiles? d. why are prices in the united states different in (c) and (b)? are consumers better off with free trade? in what ways?

Answers: 1

Business, 23.06.2019 14:00, 12camtheman

In some markets, the government regulates the price of utilities so that they are not priced out of range of peoples ability to pay. this is a example a/an

Answers: 2

Do you know the correct answer?

Mr. sam golff desires to invest a portion of his assets in rental property. he has narrowed his choi...

Questions in other subjects:

Mathematics, 10.09.2020 09:01

Mathematics, 10.09.2020 09:01

Mathematics, 10.09.2020 09:01

Mathematics, 10.09.2020 09:01

Mathematics, 10.09.2020 09:01

Mathematics, 10.09.2020 09:01

Mathematics, 10.09.2020 09:01

Mathematics, 10.09.2020 09:01

Mathematics, 10.09.2020 09:01

Mathematics, 10.09.2020 09:01