Business, 26.08.2019 22:30, moonlightparis9015

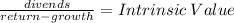

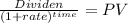

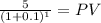

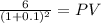

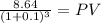

Consider the following three stocks: a. stock a is expected to provide a dividend of $10 per share forever. b. stock b is expected to pay a dividend of $5 next year. thereafter, dividend growth isexpected to be 4% per year forever. c. stock c is expected to pay a dividend of $5 next year. thereafter, dividend growth isexpected to be 20% per year for 5 years and zero thereafter. if the market capitalization rate for each stock is 10%, which stock is the most valuable?

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 16:30, jenkuehn9220

Collective bargaining provides for a representative of employees to negotiate with a representative of management over labor issues including wages. true or false?

Answers: 3

Business, 22.06.2019 07:40, carliehanson9908

Alicia has a collision deductible of $500 and a bodily injury liability coverage limit of $50,000. she hits another driver and injures them severely. the case goes to trial and there is a verdict to compensate the injured person for $40,000 how much does she pay?

Answers: 1

Business, 22.06.2019 13:30, austinmiller3030

If the economy were in the contracting phase of the business cycle, how might that affect your ability to find work?

Answers: 2

Do you know the correct answer?

Consider the following three stocks: a. stock a is expected to provide a dividend of $10 per share f...

Questions in other subjects:

History, 26.02.2020 03:54

History, 26.02.2020 03:54

![\left[\begin{array}{ccc}Year&Dividend&Present Value\\1&6&5.4545\\2&7.2&5.9504\\3&8.64&6.4914\\4&10.368&7.0815\\5&12.4416&7.7253\\Net&Value&32.7031\\\end{array}\right]](/tpl/images/0200/6005/aad06.png)