Business, 20.08.2019 20:30, carterlapere

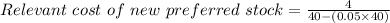

Tempo corp. will issue preferred stock to finance a new artillery line. the firm's existing preferred stock pays a dividend of $4.00 per share and is selling for $40 per share. investment bankers have advised tempo that flotation costs on the new preferred issue would be 5% of the selling price. tempo's marginal tax rate is 30%. what is the relevant cost of new preferred stock? a) 7.00%b) 7.37%c) 10.00%d) 10.53%e) 15.00%

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 08:30, dezmondpowell

Which of the following is an example of search costs? a.) driving to a faraway place to find available goods b.) buying goods in some special way that is outside the normal channels c.) paying a premium cost for goods d.) selling extra goods for a discount price

Answers: 1

Business, 22.06.2019 08:30, bartonamber4042

What has caroline's payment history been like? support your answer with two examples

Answers: 3

Business, 22.06.2019 08:30, Naomi7021

Conor is 21 years old and just started working after college. he has opened a retirement account that pays 2.5% interest compounded monthly. he plans on making monthly deposits of $200. how much will he have in the account when he reaches 591 years of age?

Answers: 2

Business, 23.06.2019 01:30, eelebron0905

Bmw receives data transmitted by each new vehicle it sells to employees understand how customers use the products and when service may be needed. this use of technology aids in bmw's efforts to interact in an ongoing basis with its customers.

Answers: 1

Do you know the correct answer?

Tempo corp. will issue preferred stock to finance a new artillery line. the firm's existing preferre...

Questions in other subjects:

Biology, 10.02.2021 05:00

Biology, 10.02.2021 05:00

Mathematics, 10.02.2021 05:00

English, 10.02.2021 05:00

Mathematics, 10.02.2021 05:00

Biology, 10.02.2021 05:00