Business, 20.08.2019 01:30, eweqwoewoji

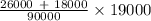

Jim has foreign income. he earns $26,000 from country a which taxes the income at a 20 percent rate. he also has income from country b of $18,000. country b taxes the $18,000 at a 10 percent rate. his us taxable income is $90,000, which includes the foreign income. his us income tax on all sources of income before credits is $19,000. what is his foreign tax credit?

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 01:00, lin550

Throne technical university is looking for three people to work in its plant-biology laboratory. the hiring manager is finding that the most suitable job candidates live in other countries and are not willing to move to the city where the university is located. which situation is the university facing? a. lack of flexible workforce b. surpluses in labor talent c. an appearance of quota systems d. deficits in minimum wage demands

Answers: 1

Business, 22.06.2019 07:30, taridunkley724

Hours to produce one unit worker hours to produce yarn country a 8 hours country b 4 hours worker hours to produce fabric counrty a 12 hours country b 13 hours additional worker hours to produce fabric instead of yarn country a ? country b? which of the follow is true of the trade relationship between country a and country b? country a has an absolute advantage in producing yarn and fabric country b has an absolute advantage in producing yarn and fabric country b has a comparative advantage to country a in producing fabric country a has a comparative advantage to country b in producing fabric

Answers: 2

Do you know the correct answer?

Jim has foreign income. he earns $26,000 from country a which taxes the income at a 20 percent rate....

Questions in other subjects:

English, 26.12.2020 03:30

Mathematics, 26.12.2020 03:40

English, 26.12.2020 03:40

English, 26.12.2020 03:50