Business, 18.08.2019 05:10, joannsrods

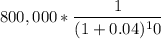

Young co. issues $800,000 of 10% bonds dated january 1, year 1. interest is payable semiannually on june 30 and december 31. the bonds mature in five years. the current market for similar bonds is 8%. the entire issue is sold on the date of issue. the following values are given: present value ofordinary annuity present value of $ =10; i=0.04 8.11090 0.67556n=10; i=0.05 7.72173 0.61391what amount of proceeds on the sale of bonds should young report? a. $799,997b. $815,564c. $849,317d. $864,884

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 19:30, jeanlucceltrick09

Consider the following two projects. both have costs of $5,000 in year 1. project 1 provides benefits of $2,000 in each of the first four years only. the second provides benefits of $2,000 for each of years 6 to 10 only. compute the net benefits using a discount rate of 6 percent. repeat using a discount rate of 12 percent. what can you conclude from this exercise?

Answers: 3

Business, 22.06.2019 21:40, Abdul111

Penny poodle wanted to know which dog obedience training program was more effective: puppy pride, the approach she has been using for any years, or doggie do-right, a new approach. penny convinced 50 human companions of untrained dogs to participate in her study. the dogs and their humans were randomly assigned to complete the puppy pride or doggie do-right course. at the end of the training programs, all of the dogs were scored on their level of obedience on a standardized dog obedience checklist (scores could range from 10 to 100). the design of this study is:

Answers: 2

Business, 22.06.2019 21:40, summerhumphries3

Engberg company installs lawn sod in home yards. the company’s most recent monthly contribution format income statement follows: amount percent of sales sales $ 80,000 100% variable expenses 32,000 40% contribution margin 48,000 60% fixed expenses 38,000 net operating income $ 10,000 required: 1. compute the company’s degree of operating leverage. (round your answer to 1 decimal place.) 2. using the degree of operating leverage, estimate the impact on net operating income of a 5% increase in sales. (do not round intermediate calculations.) 3. construct a new contribution format income statement for the company assuming a 5% increase in sales.

Answers: 3

Do you know the correct answer?

Young co. issues $800,000 of 10% bonds dated january 1, year 1. interest is payable semiannually on...

Questions in other subjects:

Advanced Placement (AP), 23.07.2019 10:30

Mathematics, 23.07.2019 10:30

Mathematics, 23.07.2019 10:30

Mathematics, 23.07.2019 10:30

. This stream of cash-flows is an ordinary annuity

. This stream of cash-flows is an ordinary annuity