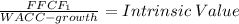

The momi corporation’s cash flow from operations before interest and taxes was $1.9 million in the year just ended, and it expects that this will grow by 5% per year forever. to make this happen, the firm will have to invest an amount equal to 19% of pretax cash flow each year. the tax rate is 21%. depreciation was $250,000 in the year just ended and is expected to grow at the same rate as the operating cash flow. the appropriate market capitalization rate for the unleveraged cash flow is 12% per year, and the firm currently has debt of $5 million outstanding. use the free cash flow approach to calculate the value of the firm and the firm’s equity. (enter your answer in dollars not in millions.)

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 03:30, levicorey846

Tiana daniels enterprise’s trial balance as at december 31, 2016 did not balance. on february 15, 2017 the following errors were detected: errorsi. water rates had been undercast by $2, 000. ii. a cheque paid to yvonne walch of $2, 680 had been posted to the credit side of her account. iii. discount received total of $1, 260 had been posted to the debit side of the discount allowed account as $1, 620. iv. rent paid in the amount of $24, 000 had been posted to the credit of the rent received account. v. wayne returned goods valuing $1, 680 to daniels enterprise but had been completely omitted from the books. required: 1. prepare the journal entries to correct the errors. (narrations required) 14.5 marks 2. prepare the suspense account showing clearly the original trial balance error. 8 marks

Answers: 2

Business, 22.06.2019 05:40, Jenan25

Grant, inc., acquired 30% of south co.’s voting stock for $200,000 on january 2, year 1, and did not elect the fair value option. the price equaled the carrying amount and the fair value of the interest purchased in south’s net assets. grant’s 30% interest in south gave grant the ability to exercise significant influence over south’s operating and financial policies. during year 1, south earned $80,000 and paid dividends of $50,000. south reported earnings of $100,000 for the 6 months ended june 30, year 2, and $200,000 for the year ended december 31, year 2. on july 1, year 2, grant sold half of its stock in south for $150,000 cash. south paid dividends of $60,000 on october 1, year 2. before income taxes, what amount should grant include in its year 1 income statement as a result of the investment?

Answers: 1

Business, 22.06.2019 20:30, jessicaisbaehood

Juanita and sam attend a beach party and notice that the local beach appears to have a great deal more trash washed up on shore than it did when they were young. the water doesn't appear nearly as clear, and there seems to be less evidence of small water creatures living in the shallows. an afternoon at the local library convinces them that one major cause is the new factory nearby. after some discussion, they decide their next step should be identifying the cause of the changes identifying the problem picketing the guilty factory lobbying their elected representatives to complain about the problem talking to a local environmental group about solutions

Answers: 3

Do you know the correct answer?

The momi corporation’s cash flow from operations before interest and taxes was $1.9 million in the y...

Questions in other subjects:

Mathematics, 10.02.2021 02:40

Mathematics, 10.02.2021 02:40

Mathematics, 10.02.2021 02:40

Social Studies, 10.02.2021 02:40