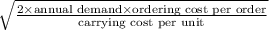

Thomas kratzer is the purchasing manager for the headquarters of a large insurance company chain with a central inventory operation. thomas's fastest-moving inventory item has a demand of 6 comma 100 units per year. the cost of each unit is $104, and the inventory carrying cost is $9 per unit per year. the average ordering cost is $29 per order. it takes about 5 days for an order to arrive, and the demand for 1 week is 122 units. (this is a corporate operation, and there are 250 working days per year). a) what is the eoq? nothing units (round your response to two decimal places).

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 02:20, unicornsflyhigh

Each month, business today publishes a news piece about an innovative product, service, or business. such soft news is generally written by a freelance business writer and is known as a

Answers: 2

Business, 22.06.2019 13:00, ksteele1

Apopular low-cost airline, parson corp., has gone out of business. although the service and price provided by the airline was what customers wanted, the larger airlines were able to drive the low-cost airline out of business through an aggressive price war. which component of the competitive environment does this illustrate? a) threat of new entrants b)competitors c) economic factors d) customers d) regulators

Answers: 1

Business, 22.06.2019 19:00, michael1498

It is estimated that over 100,000 students will apply to the top 30 m. b.a. programs in the united states this year. a. using the concept of net present value and opportunity cost, when is it rational for an individual to pursue an m. b.a. degree. b. what would you expect to happen to the number of applicants if the starting salaries of managers with m. b.a. degrees remained constant but salaries of managers without such degrees decreased by 20 percent

Answers: 3

Business, 22.06.2019 19:20, kristen17diaz

Garrett is an executive vice president at samm hardware. he researches a proposal by a larger company, maximum hardware, to combine the two companies. by analyzing past performance, conducting focus groups, and interviewing maximum employees, garrett concludes that maximum has poor profit margins, sells shoddy merchandise, and treats customers poorly. what actions should garrett and samm hardware take? a. turn down the acquisition offer and prepare to resist a hostile takeover. b. attempt a friendly merger and use managerial hubris to improve results at maximum. c. welcome the acquisition and use knowledge transfer to impart sam hardware's management practices. d. do nothing; the two companies cannot combine without samm hardware's explicit consent.

Answers: 1

Do you know the correct answer?

Thomas kratzer is the purchasing manager for the headquarters of a large insurance company chain wit...

Questions in other subjects:

Business, 01.10.2019 04:10

Mathematics, 01.10.2019 04:10

Mathematics, 01.10.2019 04:10

Mathematics, 01.10.2019 04:10

History, 01.10.2019 04:10