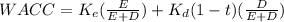

Sommer, inc., is considering a project that will result in initial aftertax cash savings of $1.79 million at the end of the first year, and these savings will grow at a rate of 3 percent per year indefinitely. the firm has a target debt-equity ratio of .85, a cost of equity of 11.9 percent, and an aftertax cost of debt of 4.7 percent. the cost-saving proposal is somewhat riskier than the usual project the firm undertakes; management uses the subjective approach and applies an adjustment factor of 2 percent to the cost of capital for such risky projects. what is the maximum initial cost the company would be willing to pay for the project?

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 16:00, bossboybaker

Analyzing and computing accrued warranty liability and expense waymire company sells a motor that carries a 60-day unconditional warranty against product failure. from prior years' experience, waymire estimates that 2% of units sold each period will require repair at an average cost of $100 per unit. during the current period, waymire sold 69,000 units and repaired 1,000 units. (a) how much warranty expense must waymire report in its current period income statement? (b) what warranty liability related to current period sales will waymire report on its current period-end balance sheet? (hint: remember that some units were repaired in the current period.) (c) what analysis issues must we consider with respect to reported warranty liabilities?

Answers: 1

Business, 22.06.2019 21:30, marlenerojas201

Which of the following is one of the five fundamental questions? which products will be in scarce supply and which in excess supply? who should appoint the head of the central bank? how much should society save? correct what goods and services will be produced?

Answers: 1

Business, 23.06.2019 04:40, Rosalycarlite5358

Maria's family drove 140 mi to her grandparents' house and averaged 56 mi/h on the way thereon the return trip, they averaged 50 mi/hwhat was the total time maria's family spent driving to and from her grandparents' house? o2.5 ho 2.6 ho5.2 ho 53 hnext

Answers: 3

Business, 23.06.2019 10:20, abadir2008

Global tek plans on increasing its annual dividend by 15 percent a year for the next four years and then decreasing the growth rate to 2.5 percent per year. the company just paid its annual dividend in the amount of $.20 per share. what is the current value of one share of this stock if the required rate of return is 17.4 percent? $1.82 $218 $2.03 $2.71 $3.05

Answers: 1

Do you know the correct answer?

Sommer, inc., is considering a project that will result in initial aftertax cash savings of $1.79 mi...

Questions in other subjects:

Mathematics, 06.02.2021 04:30

SAT, 06.02.2021 04:30

Health, 06.02.2021 04:30

Chemistry, 06.02.2021 04:30

Mathematics, 06.02.2021 04:30