Business, 22.07.2019 02:10, NotYourStudent

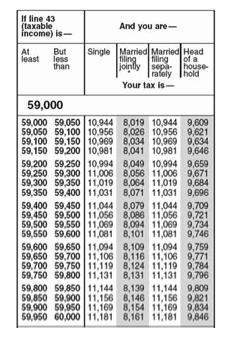

Christian's taxable income last year was $59,450. according to the tax table below, how much tax does he have to pay if he files with the "single" status? a. $11,044 b. $11,056 c. $8086 d. $9271

2b2t

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 10:00, ladnerhailey16

You are president of a large corporation. at a typical monthly meeting, each of your vice presidents gives standard area reports. in the past, these reports have been good, and the vps seem satisfied about their work. based on situational approach to leadership, which leadership style should you exhibit at the next meeting?

Answers: 2

Business, 22.06.2019 20:00, ethanyayger

Acompetitive market in healthcare would a. overprovide healthcare because the marginal social benefit of healthcare exceeds the marginal benefit perceived by consumers b. underprovide healthcare because it would eliminate medicare and medicaid c. underprovide healthcare because the marginal social benefit of healthcare exceeds the marginal benefit perceived by consumers d. overprovide healthcare because it would be similar to the approach used in canada

Answers: 1

Business, 22.06.2019 20:30, allakhalilpea0zc

Caleb construction (cc) incurs supervisor salaries expense in the construction of homes. if cc manufactures 100 homes in a year, fixed supervisor salaries will be $400,000. with the current construction supervisors, cc's productive capacity is 150 homes in a year. however, if cc is contracts to build more than 150 homes per year, it will need to hire additional supervisors, which are hired as full-time rather than temporary employees. cc's productive capacity would then become 200 homes per year, and salaries expense would increase to $470,000. how would cc’s salaries expense be properly classified? fixed variable mixed stepped curvilinear

Answers: 3

Business, 23.06.2019 01:00, angelica3752

The huntington boys and girls club is conducting a fundraiser by selling chili dinners to go. the price is $7 for an adult meal and $4 for a child’s meal. write a program that accepts the number of adult meals ordered and then children's meals ordered. display the total money collected for adult meals, children’s meals, and all meals.

Answers: 2

Do you know the correct answer?

Christian's taxable income last year was $59,450. according to the tax table below, how much tax doe...

Questions in other subjects:

History, 02.12.2021 21:30

Mathematics, 02.12.2021 21:30

English, 02.12.2021 21:30

Mathematics, 02.12.2021 21:30

Chemistry, 02.12.2021 21:30