Business, 22.07.2019 01:10, anniekwilbourne

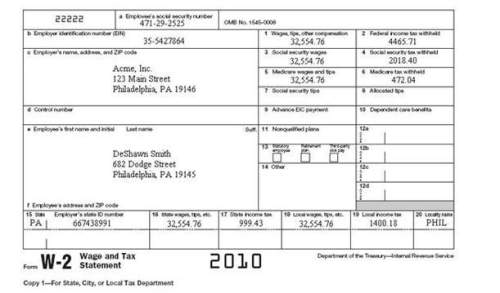

Deshawn smith's w-2 form is shown below. how much did deshawn have withheld from his yearly pay for federal income tax? a. $472.04 b. $2018.40 c. $32,554.76 d. $4465.71

2b2t

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 19:10, postorivofarms

If we know that a firm has a net profit margin of 4.6 %, total asset turnover of 0.62, and a financial leverage multiplier of 1.54, what is its roe? what is the advantage to using the dupont system to calculate roe over the direct calculation of earnings available for common stockholders divided by common stock equity?

Answers: 2

Business, 22.06.2019 21:30, schneidersamant9242

Which is cheaper: eating out or dining in? the mean cost of a flank steak, broccoli, and rice bought at the grocery store is $13.04 (money. msn website, november 7, 2012). a sample of 100 neighborhood restaurants showed a mean price of $12.75 and a standard deviation of $2 for a comparable restaurant meal. a. develop appropriate hypotheses for a test to determine whether the sample data support the conclusion that the mean cost of a restaurant meal is less than fixing a comparable meal at home. b. using the sample from the 100 restaurants, what is the p-value? c. at a = .05, what is your conclusion? d. repeat the preceding hypothesis test using the critical value approach

Answers: 3

Business, 22.06.2019 23:00, terrickaimani

Investors who put their own money into a startup are known as a. mannequins b. obligators c. angels d. borrowers

Answers: 1

Business, 22.06.2019 23:10, Schoolwork100

The direct labor budget of yuvwell corporation for the upcoming fiscal year contains the following details concerning budgeted direct labor-hours: 1st quarter 2nd quarter 3rd quarter 4th quarterbudgeted direct labor-hours 11,200 9,800 10,100 10,900the company uses direct labor-hours as its overhead allocation base. the variable portion of its predetermined manufacturing overhead rate is $6.00 per direct labor-hour and its total fixed manufacturing overhead is $80,000 per quarter. the only noncash item included in fixed manufacturing overhead is depreciation, which is $20,000 per quarter. required: 1. prepare the company’s manufacturing overhead budget for the upcoming fiscal year.2. compute the company’s predetermined overhead rate (including both variable and fixed manufacturing overhead) for the upcoming fiscal year.

Answers: 3

Do you know the correct answer?

Deshawn smith's w-2 form is shown below. how much did deshawn have withheld from his yearly pay for...

Questions in other subjects:

English, 25.09.2019 19:30

Chemistry, 25.09.2019 19:30

Chemistry, 25.09.2019 19:30

Mathematics, 25.09.2019 19:30

English, 25.09.2019 19:30

Social Studies, 25.09.2019 19:30