Business, 20.07.2019 06:10, sleimanabir

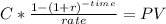

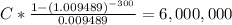

Areal estate developer is evaluating a 40-unit apartment development. the expected average occupancy is 90%. cost of land: $1,200,000 construction: $$4,800,000 project life: 25 years maintenance: $100 per unit per year (regardless of weather a unit is occupied). annual insurance and property taxes: $400,000 required return: 12% per year (0.9489% per month) assume that the building will have no salvage value at the end of 25 years, but the land will appreciate at a rate of 5% per year. determine the total minimum monthly rent (all units combined) that should be charged, given the required return.

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 22:10, maddy6882

You have just received notification that you have won the $2.0 million first prize in the centennial lottery. however, the prize will be awarded on your 100th birthday (assuming you're around to collect), 66 years from now. what is the present value of your windfall if the appropriate discount rate is 8 percent?

Answers: 1

Business, 23.06.2019 03:20, hrijaymadathil

Milden company has an exclusive franchise to purchase a product from the manufacturer and distribute it on the retail level. as an aid in planning, the company has decided to start using a contribution format income statement. to have data to prepare such a statement, the company has analyzed its expenses and has developed the following cost formulas: cost cost formula cost of good sold $35 per unit sold advertising expense $210,000 per quarter sales commissions 6% of sales shipping expense ? administrative salaries $145,000 per quarter insurance expense $9,000 per quarter depreciation expense $76,000 per quarter management has concluded that shipping expense is a mixed cost, containing both variable and fixed cost elements. units sold and the related shipping expense over the last eight quarters follow: quarter units sold shipping expense year 1: first 10,000 $ 119,000 second 16,000 $ 175,000 third 18,000 $ 190,000 fourth 15,000 $ 164,000 year 2: first 11,000 $ 130,000 second 17,000 $ 185,000 third 20,000 $ 210,000 fourth 13,000 $ 147,000 milden company’s president would like a cost formula derived for shipping expense so that a budgeted contribution format income statement can be prepared for the next quarter. required: 1. using the high-low method, estimate a cost formula for shipping expe

Answers: 2

Business, 23.06.2019 20:00, bearminar2156

Abrief overview of your company's strengths, weaknesses, opportunities, and threats is called a branding strategy. financial evaluation. paranoid scenario. situational analysis.

Answers: 1

Business, 23.06.2019 21:00, rainbowboi

Which of these statements regarding organizational buyers is most accurate? a. wholesalers and retailers resell the goods they buy without reprocessing them?

Answers: 2

Do you know the correct answer?

Areal estate developer is evaluating a 40-unit apartment development. the expected average occupancy...

Questions in other subjects:

Chemistry, 02.05.2021 22:50

Mathematics, 02.05.2021 22:50

English, 02.05.2021 22:50

Social Studies, 02.05.2021 22:50