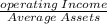

The south division of wiig company reported the following data for the current year. sales $3,018,000 variable costs 1,979,808 controllable fixed costs 594,600 average operating assets 5,087,200 top management is unhappy with the investment center’s return on investment (roi). it asks the manager of the south division to submit plans to improve roi in the next year. the manager believes it is feasible to consider the following independent courses of action. 1. increase sales by $320,000 with no change in the contribution margin percentage. 2. reduce variable costs by $151,500. 3. reduce average operating assets by 3%. (a) compute the return on investment (roi) for the current year. (round roi to 1 decimal place, e. g. 1.5.)

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 11:00, neash19

Why does an organization prepare a balance sheet? a. to reveal what the organization owns and owes at a point in time b. to reveal how well the company utilizes its cash c. to calculate retained earnings for a given accounting period d. to calculate gross profit for a given accounting period

Answers: 3

Business, 22.06.2019 11:10, chloeholt123

Which of the following is an example of a production quota? a. the government sets an upper limit on the quantity that each dairy farmer can produce. b. the government sets a price floor in the market for dairy products. c. the government sets a lower limit on the quantity that each dairy farmer can produce. d. the government guarantees to buy a specified quantity of dairy products from farmers.

Answers: 2

Business, 23.06.2019 00:30, landofliam30

Suppose the government decides to issue a new savings bond that is guaranteed to double in value if you hold it for 20 years. assume you purchase a bond that costs $25. a. what is the exact rate of return you would earn if you held the bond for 20 years until it doubled in value? (do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e. g., 32.16.) b. if you purchased the bond for $25 in 2017 at the then current interest rate of .27 percent year, how much would the bond be worth in 2027? (do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.) c. in 2027, instead of cashing in the bond for its then current value, you decide to hold the bond until it doubles in face value in 2037. what annual rate of return will you earn over the last 10 years? (do not

Answers: 3

Do you know the correct answer?

The south division of wiig company reported the following data for the current year. sales $3,018,00...

Questions in other subjects:

History, 19.12.2019 19:31

Social Studies, 19.12.2019 19:31

English, 19.12.2019 19:31

History, 19.12.2019 19:31

Mathematics, 19.12.2019 19:31

English, 19.12.2019 19:31

Mathematics, 19.12.2019 19:31