Business, 18.07.2019 02:30, ikramhamideh

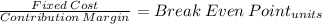

Gitli company sells its product for $ 55 and has variable cost of $ 30 per unit. the total fixed costs are $ 25,000. what will be the effect on the breakeven point in units if variable cost increases by $ 5 due to an increase in the cost of direct materials? a. it will increase by 250 units. b. it will decrease by 167 units. c. it will decrease by 250 units. d. it will increase by 167 units.

Answers: 2

Other questions on the subject: Business

Business, 23.06.2019 00:40, derisepicowe0fa

An upper-middle-class manager tends to have hostile relationship with the working-class employees in the firm because of his tendency to perceive himself as superior to them based on his class background. in this example, the manager exhibits: question 14 options: 1) class consciousness. 2) cultural awareness. 3) social mobility. 4) group orientation.

Answers: 3

Business, 23.06.2019 01:30, Joshuafranklindude

Lee earns $1,482 of interest in 270 days after making a deposit of $15,200. find the interest rate.

Answers: 1

Business, 23.06.2019 15:00, Osorio5116

How should the environmental effects be dealt with when evaluating this project? the environmental effects should be ignored since the plant is legal without mitigation. the environmental effects should be treated as a sunk cost and therefore ignored. if the utility mitigates for the environmental effects, the project is not acceptable. however, before the company chooses to do the project without mitigation, it needs to make sure that any costs of "ill will" for not mitigating for the environmental effects have been considered in the original analysis. the environmental effects should be treated as a remote possibility and should only be considered at the time in which they actually occur. the environmental effects if not mitigated would result in additional cash flows. therefore, since the plant is legal without mitigation, there are no benefits to performing a "no mitigation" analysis.

Answers: 1

Business, 23.06.2019 16:00, lanc3r3vo

On january 2, 2016, twilight hospital purchased a $94,800 special radiology scanner from bella inc. the scanner had a useful life of 4 years and was estimated to have no disposal value at the end of its useful life. the straight-line method of depreciation is used on this scanner. annual operating costs with this scanner are $106,000. approximately one year later, the hospital is approached by dyno technology salesperson, jacob cullen, who indicated that purchasing the scanner in 2016 from bella inc. was a mistake. he points out that dyno has a scanner that will save twilight hospital $26,000 a year in operating expenses over its 3-year useful life. jacob notes that the new scanner will cost $111,000 and has the same capabilities as the scanner purchased last year. the hospital agrees that both scanners are of equal quality. the new scanner will have no disposal value. jacob agrees to buy the old scanner from twilight hospital for $40,500. if twilight hospital sells its old scanner on january 2, 2017, compute the gain or loss on the sale. prepare an incremental analysis of twilight hospital.

Answers: 2

Do you know the correct answer?

Gitli company sells its product for $ 55 and has variable cost of $ 30 per unit. the total fixed cos...

Questions in other subjects:

Biology, 03.02.2020 18:01

Health, 03.02.2020 18:01

Physics, 03.02.2020 18:01

Geography, 03.02.2020 18:01

History, 03.02.2020 18:01

Mathematics, 03.02.2020 18:01