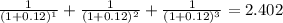

Bradford services inc. (bsi) is considering a project that has a cost of $10 million and an expected life of 3 years. there is a 30 percent probability of good conditions, in which case the project will provide a cash flow of $9 million at the end of each year for 3 years. there is a 40 percent probability of medium conditions, in which case the annual cash flows will be $4 million, and there is a 30 percent probability of bad conditions and a cash flow of $1 million per year. bsi uses a 12 percent cost of capital to evaluate projects like this. find the project's expected cash flows and npv.

Answers: 3

Similar questions

Business, 13.08.2019 00:20, cache77

Answers: 2

Business, 11.10.2019 22:10, lydia1melton

Answers: 2

Business, 23.10.2019 19:20, isaiaspineda09pe6ljq

Answers: 2

Business, 25.10.2019 02:43, jaleelat3164

Answers: 2

Do you know the correct answer?

Bradford services inc. (bsi) is considering a project that has a cost of $10 million and an expected...

Questions in other subjects:

Mathematics, 10.10.2021 08:30

Mathematics, 10.10.2021 08:30

Mathematics, 10.10.2021 08:30

Chemistry, 10.10.2021 08:30

English, 10.10.2021 08:30