Business, 13.07.2019 06:10, kealinwiley

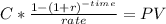

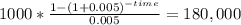

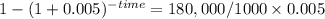

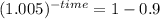

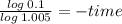

House loan. suppose you take out a home mortgage for $180,000 at a monthly interest rate of 0.5%. if you make payments of $1000/month, after how many months will the loan balance be zero?

Answers: 1

Similar questions

Business, 20.07.2019 02:30, Dpj21

Answers: 3

Mathematics, 22.07.2019 05:30, christopherschool04

Answers: 1

Mathematics, 31.07.2019 00:20, kendelllh

Answers: 2

Computers and Technology, 06.10.2019 04:00, AceGravity

Answers: 3

Do you know the correct answer?

House loan. suppose you take out a home mortgage for $180,000 at a monthly interest rate of 0.5%. if...

Questions in other subjects:

Health, 12.02.2020 00:26

Physics, 12.02.2020 00:26