Business, 12.07.2019 19:20, tnbankspines

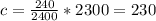

Video planet (“vp”) sells a big screen tv package consisting of a 60-inch plasma tv, a universal remote, and on-site installation by vp staff. the installation includes programming the remote to have the tv interface with other parts of the customer’s home entertainment system. vp concludes that the tv, remote, and installation service are separate performance obligations. vp sells the 60-inch tv separately for $2,040, sells the remote separately for $120, and offers the installation service separately for $240. the entire package sells for $2,300. required: how much revenue would be allocated to the tv, the remote, and the installation service?

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 05:00, leonidas117

Which of the following differentiates cost accounting and financial accounting? a. the primary users of cost accounting are the investors, whereas the primary users of financial accounting are the managers. b. cost accounting measures only the financial information related to the costs of acquiring fixed assets in an organization, whereas financial accounting measures financial and nonfinancial information of a company's business transactions. c. cost accounting measures information related to the costs of acquiring or using resources in an organization, whereas financial accounting measures a financial position of a company to investors, banks, and external parties. d. cost accounting deals with product design, production, and marketing strategies, whereas financial accounting deals mainly with pricing of the products.

Answers: 3

Business, 22.06.2019 16:50, bri663

Coop inc. owns 40% of chicken inc., both coop and chicken are corporations. chicken pays coop a dividend of $10,000 in the current year. chicken also reports financial accounting earnings of $20,000 for that year. assume coop follows the general rule of accounting for investment in chicken. what is the amount and nature of the book-tax difference to coop associated with the dividend distribution (ignoring the dividends received deduction)?

Answers: 2

Business, 22.06.2019 17:40, bsheepicornozj0gc

Within the relevant range, if there is a change in the level of the cost driver, then a. total fixed costs will remain the same and total variable costs will change b. total fixed costs will change and total variable costs will remain the same c. total fixed costs and total variable costs will change d. total fixed costs and total variable costs will remain the same

Answers: 3

Do you know the correct answer?

Video planet (“vp”) sells a big screen tv package consisting of a 60-inch plasma tv, a universal rem...

Questions in other subjects:

Health, 28.04.2021 03:00

History, 28.04.2021 03:00

English, 28.04.2021 03:00

![\left[\begin{array}{ccc}$TV&2040&a\\$Remote&120&b\\$Installation&240&c\\$Total&2400&2300\\\end{array}\right]](/tpl/images/0082/0172/24c41.png)