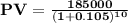

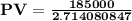

Suppose you are committed to owning a $185,000 ferrari. if you believe your mutual fund can achieve an annual return of 10.5 percent, and you want to buy the car in 10 years on the day you turn 30, how much must you invest today? (do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.) amount to be invested

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 19:40, saggirl1209

Which of the following actions is most likely to result in a decrease in the money supply? a. the required reserve ratio for banks is decreased. b. the discount rate on overnight loans is lowered. c. the federal reserve bank buys treasury bonds. d. the government sells a new batch of treasury bonds. 2b2t

Answers: 1

Business, 21.06.2019 22:20, arijade1391

Why should you not sign the tenant landlord agreement quickly and immediately

Answers: 1

Business, 22.06.2019 10:40, meillsss

Parks corporation is considering an investment proposal in which a working capital investment of $10,000 would be required. the investment would provide cash inflows of $2,000 per year for six years. the working capital would be released for use elsewhere when the project is completed. if the company's discount rate is 10%, the investment's net present value is closest to (ignore income taxes) ?

Answers: 1

Business, 22.06.2019 11:30, khynia11

Given the following information about the closed economy of brittania, what is the level of investment spending and private savings, and what is the budget balance? assume there are no government transfers. gdp=$1180.00 million =$510.00 million =$380.00 million =$280.00 million

Answers: 3

Do you know the correct answer?

Suppose you are committed to owning a $185,000 ferrari. if you believe your mutual fund can achieve...

Questions in other subjects:

Mathematics, 31.07.2019 12:30

Mathematics, 31.07.2019 12:30

History, 31.07.2019 12:30

Mathematics, 31.07.2019 12:30

Physics, 31.07.2019 12:30

Mathematics, 31.07.2019 12:30

Mathematics, 31.07.2019 12:30