Business, 11.07.2019 07:00, imknutson962

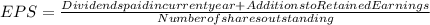

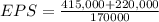

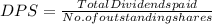

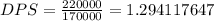

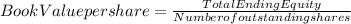

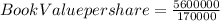

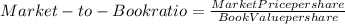

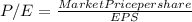

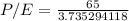

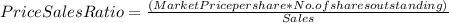

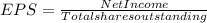

Makers corp. had additions to retained earnings for the year just ended of $415,000. the firm paid out $220,000 in cash dividends, and it has ending total equity of $5.6 million. the company currently has 170,000 shares of common stock outstanding. a. what are earnings per share? (do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.) b. what are dividends per share? (do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.) c. what is the book value per share? (do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.) d. if the stock currently sells for $65 per share, what is the market-to-book ratio? (do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.) e. what is the price-earnings ratio? (do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.) f. if the company had sales of $7.45 million, what is the price-sales ratio? (do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.)

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 00:50, BARRION1981

Hanna intends to give her granddaughter, melodee, her antique hat pin. this heirloom has been kept under lock and key in the wall vault in the library of hanna's house in virginia. the hat pin is currently the only item in the vault. when hanna is visiting melodee in connecticut, hanna gives melodee the only key to the vault. melodee is grateful for the present and excitedly accepts. in this situation has there been a completed gift?

Answers: 3

Business, 22.06.2019 11:00, mmcdaniels46867

Companies hd and ld are both profitable, and they have the same total assets (ta), total invested capital, sales (s), return on assets (roa), and profit margin (pm). both firms finance using only debt and common equity. however, company hd has the higher total debt to total capital ratio. which of the following statements is correct? a) company hd has a higher assets turnover than company ld. b) company hd has a higher return on equity than company ld. c) none of the other statements are correct because the information provided on the question is not enough. d) company hd has lower total assets turnover than company ld. e) company hd has a lower operating income (ebit) than company ld

Answers: 2

Business, 22.06.2019 16:30, cadenbukvich9923

Why is investing in a mutual fund less risky than investing in a particular company’s stock?

Answers: 3

Business, 22.06.2019 23:30, SmolBeanPotato

Shelby bought her dream car, a 1966 red convertible mustang, with a loan from her credit union. if shelby paid 5.1% and the bank earned a real rate of return of 3.5%, what was the inflation rate over the life of the loan?

Answers: 2

Do you know the correct answer?

Makers corp. had additions to retained earnings for the year just ended of $415,000. the firm paid o...

Questions in other subjects:

Mathematics, 01.09.2020 22:01

Mathematics, 01.09.2020 22:01

English, 01.09.2020 22:01

Biology, 01.09.2020 22:01

History, 01.09.2020 22:01

Mathematics, 01.09.2020 22:01

,

,